| Taxation - 4620 |

|

|||||||||||||||||||||||||||||||||||||||||||

Program Summary

The Bachelor of Taxation Degree commenced in 1991 and was the first university undergraduate tax degree offered in Australia.

The Bachelor of Taxation can be studied over three years full-time with four courses (or equivalent units of credit) per semester, or six years part-time with two courses (or equivalent) per semester. It is based on the equivalent of 24 courses, of 6 units of credit per course, including 16 core and 8 electives. Some UNSW General Education courses carry only half the credits (3 units of credit) and workload of mainstream courses. Enrolment in such courses could increase the total number of courses to 26. Students who wish to meet professional accounting entry requirements must study the accounting courses indicated by the Institute of Chartered Accountants in Australia (ICAA) and CPA Australia. (See 'Particular Requirements for Accounting Professional Entry') Occupational Destination of Graduates

Atax graduates are leading fulfilling careers in all parts of private and public practice. They are employed by accounting and legal majors, in the tax groups of large and medium sized corporations, in smaller accounting and law firms and in the Federal Treasury, Australian Taxation Office, State Government Treasury Departments and Revenue Offices.

The accounting stream of the Bachelor of Taxation Degree has been considered as satisfying the prescribed qualifications criterion of INCOME TAX REGULATION 156 for registration with the Tax Agents' Board. Professional Accreditation

The Bachelor of Taxation program has been granted accreditation by CPA Australia and the Institute of Chartered Accountants in Australia (ICAA). This means the Bachelor of Taxation satisfies the educational requirements for associate level of membership, provided the student has studied elective courses in the accounting stream of the Bachelor of Taxation. These course choices and study sequences are explained below in the section 'Requirements for Accounting Professional Entry'.

Student Workload

Part-time students will normally complete two courses per semester. Full-time students will normally complete four courses per semester. 'Full-time' students are defined as having a load of 0.75 or more (0.375 per semester). Contact will vary from course to course. As a rough guide, students can expect to spend at least 12 hours per week studying each course.

It is possible to take a lighter workload, studying one course per semester. In special circumstances with approval from the program convenor, a heavier load could be taken. That would depend to some extent on the student's prior academic record. Program Objectives and Learning Outcomes The objectives of the Bachelor of Taxation are to provide students with:

To complete the Bachelor of Taxation, students are required to do a total of 24-26 courses (or 25-27 if commenced prior to 1999):

Required

Special Category Courses

Two of the following courses must be completed: Elective Courses

Four of the following must be completed:

Courses designated ATAX06## are postgraduate courses offered at the undergraduate level. They are only available at an advanced stage of the program and only to students who satisfy the relevant course authority they are capable of coping with the demands of the course.

General Education Requirements Students enrolled in this program must also satisfy the University's General Education requirements.

Twelve units of credit of General Education must be successfully completed. General Education requirements may, with the prior approval of the BTax Convenor, be fulfilled by completion of courses offered in other faculties within UNSW or at other universities. Some of these courses have lower credit value and workload than Atax courses. Assessment Policy

The Board of Studies in Taxation has resolved that, in order to pass a course, candidates for the Bachelor of Taxation should obtain:

Bachelor of Taxation Degree with Distinction

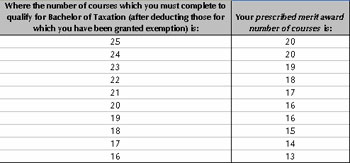

The Assessment Committee of the Board of Studies in Taxation may award the Bachelor of Taxation degree with Distinction when a student satisfies the condition of a 75% weighted average mark (WAM) attained over the student's degree. Bachelor of Taxation Degree with Merit For students who entered the Bachelor of Taxation program prior to 2003, the Assessment Committee of the Board of Studies in Taxation may award the Bachelor of Taxation Degree with Merit when a student satisfies the following conditions:

Provided that where, in the opinion of the Examiners at the Assessment Committee, 'exceptional circumstances' exist the Assessment Committee may award the degree with Merit even though a student has not attained a 70% average and/or has three failures throughout the program.

Students enrolled in BTax prior to 2003 and therefore eligible for award of either the BTax with Merit or the BTax with Distinction have the option of taking out one or the other award. For information regarding fees for UNSW programs, please refer to the following website: https://my.unsw.edu.au/student/fees/FeesMainPage.html

Exemption Policy/Advanced Standing Students accepted for enrolment into the Bachelor of Taxation Degree may apply for advanced standing (exemptions from study of particular courses) by completing the form Course Exemption/Advanced Standing. This is available for download from:

http://www.atax.unsw.edu.au/students/forms. Maximum exemption for the BTax is for eight courses of 6 units of credit. The policy on advanced standing for BTax can be accessed at: http://www.atax.unsw.edu.au/study/exemptions.htm#btaxpol Particular Requirements for Accounting Professional Entry Students wanting to gain accounting admission must study the following:

Also one of the following three other special category courses must be chosen:

Finally, three of the four general electives must be accounting courses. The following three elective courses must be chosen:

Hence in practice the only decision to be made for students seeking professional accounting entry is between ATAX0020, ATAX0022 and ATAX0023, are general elective and in the General Education area.

However, Atax also recommends that ATAX0058 be studied as the extra general elective before attempting ATAX0057. As requirements change from time to time, students should check any updates or changes to requirements later in their degree program. Prescribed merit award number of courses table

Area(s) of Specialisation |

||||||||||||||||||||||||||||||||||||||||||||

| Contacts | Library | myUNSW | WebCT |