Taxation - 4620

Program Summary

Faculty: Australian School of Business

Contact: http://www.blt.unsw.edu.au/

Campus: ATAX Campus

Career: Undergraduate

Typical Duration: 3 Years

Typical UOC Per Semester: 24

Min UOC Per Semester: 3

Max UOC Per Semester: 27

Min UOC For Award: 144

UAC Code: 424015

International Entry Requirements: See International Entry Requirements

Award(s):

Bachelor of Taxation (Major)

Information valid for students commencing 2013.

Students who commenced prior to 2013 should go to the Handbook's Previous Editions

Program Description

The Bachelor of Taxation Degree commenced in 1991 and was the first university undergraduate tax degree offered in Australia.

The Bachelor of Taxation can be studied over three years full-time with four courses (or equivalent units of credit) per semester, or six years part-time with two courses (or equivalent) per semester. It is based on the equivalent of 24 courses (6 units of credit per course) consisting 22 core and elective courses in Taxation and related areas, and 2 General Education courses.

Students who wish to meet professional accounting entry requirements must study the accounting courses indicated by the Institute of Chartered Accountants in Australia (ICAA) and CPA Australia.

Students wishing to become registered tax agents should consult the Tax Practioners Board for guidance on current educational requirements.

It is possible to take a lighter workload, studying one course per semester. In special circumstances with approval from the program convenor, a heavier load could be taken. That would depend to some extent on the student's prior academic record.

Program Objectives and Graduate Attributes

- a broad-based education in all areas relevant to taxation (including law, accounting, economics and computing) as well as a vocationally specific education;

- knowledge of the basic structure of the Australian tax system, of the essential concepts that underpin taxation, and of the Income Tax Assessment Act and related Acts;

- knowledge of accounting and reporting information, processes and systems, and the integration of such knowledge with the tax system;

- knowledge of legal concepts and principles involved in areas such as contract law, commercial law, administrative law, litigation, company law, banking and finance, property, trusts and equity, and the integration of such knowledge with the tax system;

- skills of statutory interpretation and case analysis;

- skills in organising and solving complex problems by the collection, analysis and application of relevant laws, rules, standards or other information;

- skills of oral and written communication, of negotiation and of advocacy;

- the ability to apply the processes of critical reasoning in evaluating the broad institutional and economic outcomes of tax decisions, including an application of major economic, organisational and information processing concepts;

- the ability to judge appropriate standards of ethical behaviour in their dealings with clients, customers and tax administrators in the tax profession; and

- an awareness of the role of liberal studies as part of a general university education through, in part, the critical analysis of their own professional culture and by exposure in all courses to the broad traditions of critical enquiry.

Program Structure

- 8 core courses = 48 UOC

- 14 courses for the Major = 84 UOC

- 2 General Education courses = 12 UOC

- ATAX0001 Principles of Aust. Tax. Law (6 UOC)

- ATAX0002 Computer Information Systems (6 UOC)

- ATAX0003 Microeconomics & Aust Tax Syst (6 UOC)

- ATAX0004 Framework of Commercial Law (6 UOC)

- ATAX0005 Accounting 1 (6 UOC)

- ATAX0006 Tax Administrative Law (6 UOC)

- ATAX0011 Macroecon,Government & Economy (6 UOC)

- ATAX0058 Quantitative Analysis (6 UOC)

To obtain the Major, students should complete the 5 compulsory courses for the Major AND nine (9) electives chosen from List A and List B below.

Compulsory courses for the Major

Choose at least nine courses from the lists A and B below.

Students wishing to receive accounting accreditation need to complete the electives in List A. If students do not seek accounting recognition they may still complete one or more of these electives

- ATAX0603 Taxation of Corporations (6 UOC)

- ATAX0605 Taxation of Trusts (6 UOC)

- ATAX0607 Taxation of Corporate Finance (6 UOC)

- ATAX0610 Taxation of Superannuation (6 UOC)

- ATAX0611 Taxation of Capital Gains (6 UOC)

- ATAX0620 Principles of Aust. Inter. Tax (6 UOC)

- ATAX0622 GST: Design & Structure (6 UOC)

- ATAX0623 Principles of GST Law (6 UOC)

- ATAX0625 Tax of Employee Remuneration (6 UOC)

- ATAX0626 Tax & Invest Reg in China (6 UOC)

- ATAX0628 Int. Tax: Design & Structure (6 UOC)

- ATAX0631 Principles of Revenue Administ (6 UOC)

- ATAX0640 SMSF Law (6 UOC)

- ATAX0641 Comparative Tax Systems (6 UOC)

- ATAX0655 Taxation of Prop. Transactions (6 UOC)

General Education Requirements

Twelve units of credit of General Education must be successfully completed. General Education requirements may, with the prior approval of the BTax Convenor, be fulfilled by completion of courses offered in other faculties within UNSW or at other universities. Some of these courses have lower credit value and workload than Atax courses.

Academic Rules

To be awarded a degree at Pass level, the BTax must contain:

1. 144 units of credit (UOC).

2. A minimum of 132 UOC of courses offered by the ASB.

3. 12UOC of courses from outside the ASB to fulfil the University’s General Education requirement.

Awarding degree

A Pass degree with Distinction may be awarded if a student achieves a minimum of 75 WAM across the program and completes a minimum of 72UOC at UNSW.

- 50% or more of the total marks available in the course and

- a minimum of 40% of the marks available for the final examination in the course.

Fees

Exemption Policy/Advanced Standing

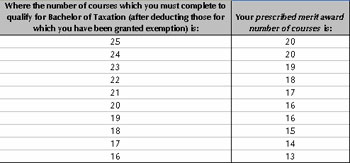

Prescribed merit award number of courses table

|

Area(s) of Specialisation