|

||||||||||||||||||||||||||||||||||||||||||||

| Taxation - 4620 | ||||||||||||||||||||||||||||||||||||||||||||

The Bachelor of Taxation Degree commenced in 1991 and was the first university undergraduate tax degree offered in Australia.

The Bachelor of Taxation can be studied over three years full-time with four courses (or equivalent units of credit) per semester, or six years part-time with two courses (or equivalent) per semester. It is based on the equivalent of 22 courses, of 6 units of credit per course, including 12 core and 10 electives plus 2 General Education courses to a total of 12 units of credit. Some UNSW General Education courses may carry only half the credits (3 units of credit) and workload of mainstream courses. Enrolment in such courses could increase the total number of courses to 26. Students who wish to meet professional accounting entry requirements must study the accounting courses indicated by the Institute of Chartered Accountants in Australia (ICAA) and CPA Australia. Occupational Destination of Graduates

Atax graduates are leading fulfilling careers in all parts of private and public practice. They are employed by accounting and legal majors, in the tax groups of large and medium sized corporations, in smaller accounting and law firms and in the Federal Treasury, Australian Taxation Office, State Government Treasury Departments and Revenue Offices.

The accounting stream of the Bachelor of Taxation Degree has been considered as satisfying the prescribed Accounting qualifications criterion of INCOME TAX REGULATION 156 for registration with the Tax Agents' Board. Depending on courses studied and changing Board practices some candidates may require limited further study to meet specific Board expectations. The Tax Agents' Board should be consulted for guidance. Professional Accreditation

The Bachelor of Taxation program has been granted accreditation by CPA Australia and the Institute of Chartered Accountants in Australia (ICAA). This means the Bachelor of Taxation satisfies the educational requirements for associate level of membership, provided the student has studied elective courses in the accounting stream of the Bachelor of Taxation. These course choices and study sequences are explained below.

Student Workload

Part-time students will normally complete two courses per semester. Full-time students will normally complete four courses per semester. 'Full-time' students are defined as having a load of 0.75 or more (0.375 per semester). Contact will vary from course to course. As a rough guide, students can expect to spend at least 12 hours per week studying each course.

It is possible to take a lighter workload, studying one course per semester. In special circumstances with approval from the program convenor, a heavier load could be taken. That would depend to some extent on the student's prior academic record. Program Objectives and Learning Outcomes The objectives of the Bachelor of Taxation are to provide students with:

Students commencing enrolment in the Bachelor of Taxation from Semester 1 2008 onwards should complete 12 core courses plus 10 electives plus 12 units of credit in General Education courses. The choice of electives is dependent on whether students seek an accounting accreditation (see below). Students should be aware that even if they do not seek an accounting accreditation they may still do one or more of the accounting electives.

12 core courses are required as follows:

5 Accounting Accreditation Electives

Elective Courses

5 other electives (out of 14) are required if 5 Accounting Accreditation electives are taken or up to 10 other electives (out of 14) are required if Accounting Accreditation electives are not taken. List of Other Electives as follows:

Students are advised to complete the core courses prior to undertaking the electives.

Transitional Rules and Arrangements to New 2008 Structure

Students who commenced their Bachelor of Taxation prior to Semester 1 2008 should refer to the Transitional Rules and Arrangements available at http://www.atax.unsw.edu.au/students/docs/ATAX-BTax-Transitional-Arrangements-Notification.pdf General Education Requirements Students enrolled in this program must also satisfy the University's General Education requirements.

Twelve units of credit of General Education must be successfully completed. General Education requirements may, with the prior approval of the BTax Convenor, be fulfilled by completion of courses offered in other faculties within UNSW or at other universities. Some of these courses have lower credit value and workload than Atax courses. Assessment Policy

The Australian School of Taxation has resolved that, in order to pass a course, candidates for the Bachelor of Taxation should obtain:

Bachelor of Taxation Degree with Distinction

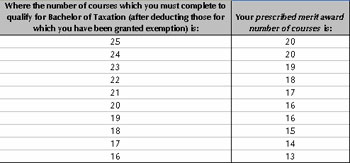

The Assessment Committee of the Board of Studies in Taxation may award the Bachelor of Taxation degree with Distinction when a student satisfies the condition of a 75% weighted average mark (WAM) attained over the student's degree. Bachelor of Taxation Degree with Merit For students who entered the Bachelor of Taxation program prior to 2003, the Assessment Committee of the Australian School of Taxation may award the Bachelor of Taxation Degree with Merit when a student satisfies the following conditions:

Provided that where, in the opinion of the Examiners at the Assessment Committee, 'exceptional circumstances' exist the Assessment Committee may award the degree with Merit even though a student has not attained a 70% average and/or has three failures throughout the program.

Students enrolled in BTax prior to 2003 and therefore eligible for award of either the BTax with Merit or the BTax with Distinction have the option of taking out one or the other award. For information regarding fees for UNSW programs, please refer to the following website: https://my.unsw.edu.au/student/fees/FeesMainPage.html

Exemption Policy/Advanced Standing Students accepted for enrolment into the Bachelor of Taxation Degree may apply for advanced standing (exemptions from study of particular courses) by completing the form Course Exemption/Advanced Standing. This is available for download from:

http://www.atax.unsw.edu.au/students/forms. Maximum exemption for the BTax is for eight courses of 6 units of credit. The policy on advanced standing for BTax can be accessed at: http://www.atax.unsw.edu.au/study/exemptions.htm#btaxpol Prescribed merit award number of courses table

Area(s) of Specialisation |

||||||||||||||||||||||||||||||||||||||||||||